5 Simple Techniques For Stonewell Bookkeeping

Some Known Details About Stonewell Bookkeeping

Table of ContentsSome Known Questions About Stonewell Bookkeeping.The Ultimate Guide To Stonewell BookkeepingThe Single Strategy To Use For Stonewell BookkeepingThings about Stonewell BookkeepingThe 7-Minute Rule for Stonewell Bookkeeping

Every organization, from hand-made fabric manufacturers to video game developers to dining establishment chains, gains and spends cash. Bookkeepers help you track all of it. But what do they really do? It's tough knowing all the response to this concern if you've been exclusively focused on growing your organization. You could not totally understand and even begin to fully value what a bookkeeper does.The background of bookkeeping go back to the start of commerce, around 2600 B.C. Early Babylonian and Mesopotamian bookkeepers kept documents on clay tablet computers to keep accounts of deals in remote cities. In colonial America, a Waste Book was commonly used in bookkeeping. It included a day-to-day journal of every purchase in the chronological order.

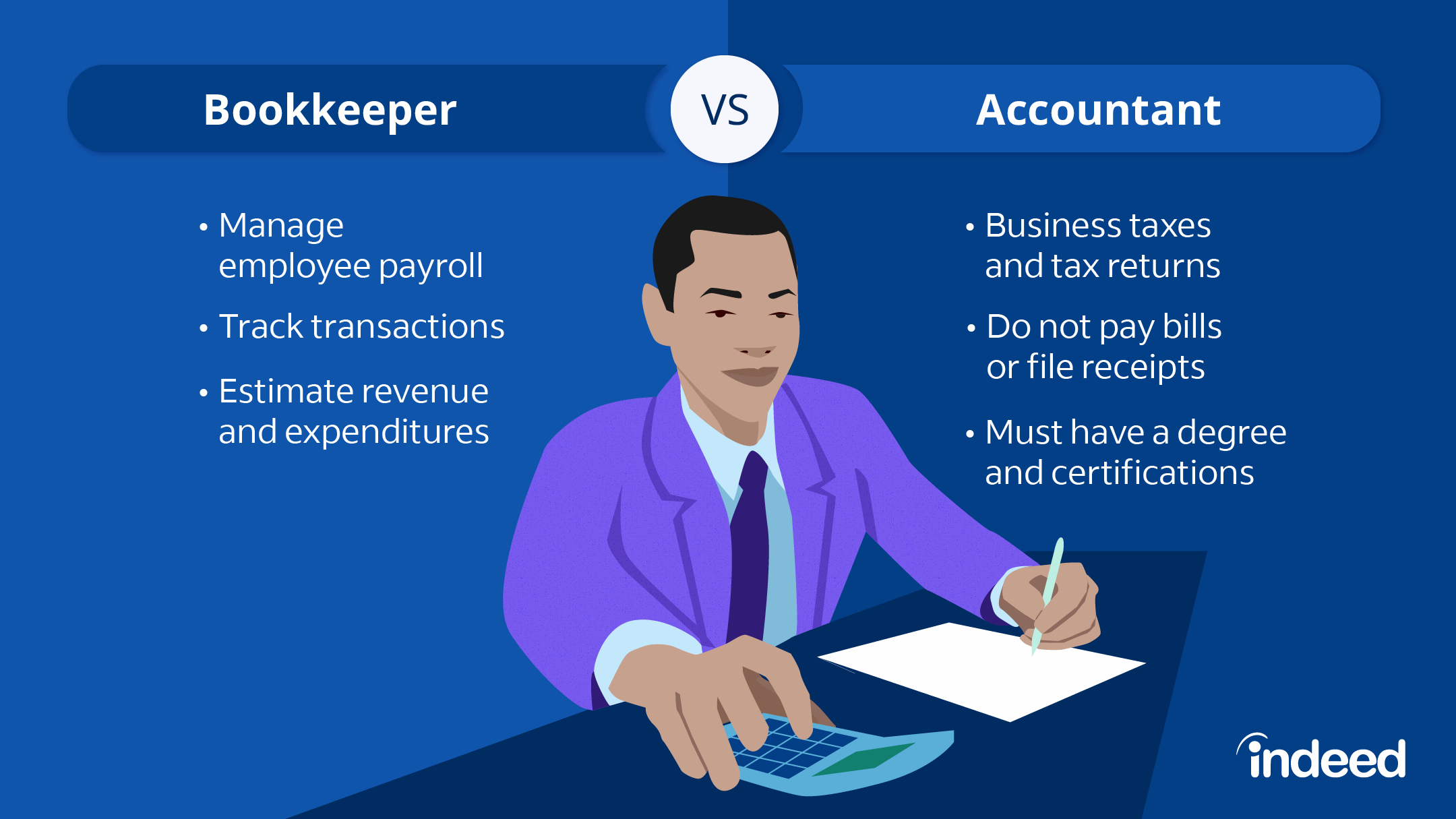

Tiny businesses may depend solely on an accountant in the beginning, however as they expand, having both experts on board comes to be significantly useful. There are two main kinds of bookkeeping: single-entry and double-entry accounting. records one side of a monetary deal, such as adding $100 to your expense account when you make a $100 acquisition with your bank card.

Facts About Stonewell Bookkeeping Revealed

includes videotaping financial transactions by hand or utilizing spreadsheets - Bookkeeping. While low-cost, it's time consuming and vulnerable to mistakes. usages tools like Sage Cost Management. These systems automatically sync with your bank card networks to provide you charge card transaction data in real-time, and automatically code all information around expenditures consisting of jobs, GL codes, areas, and classifications.

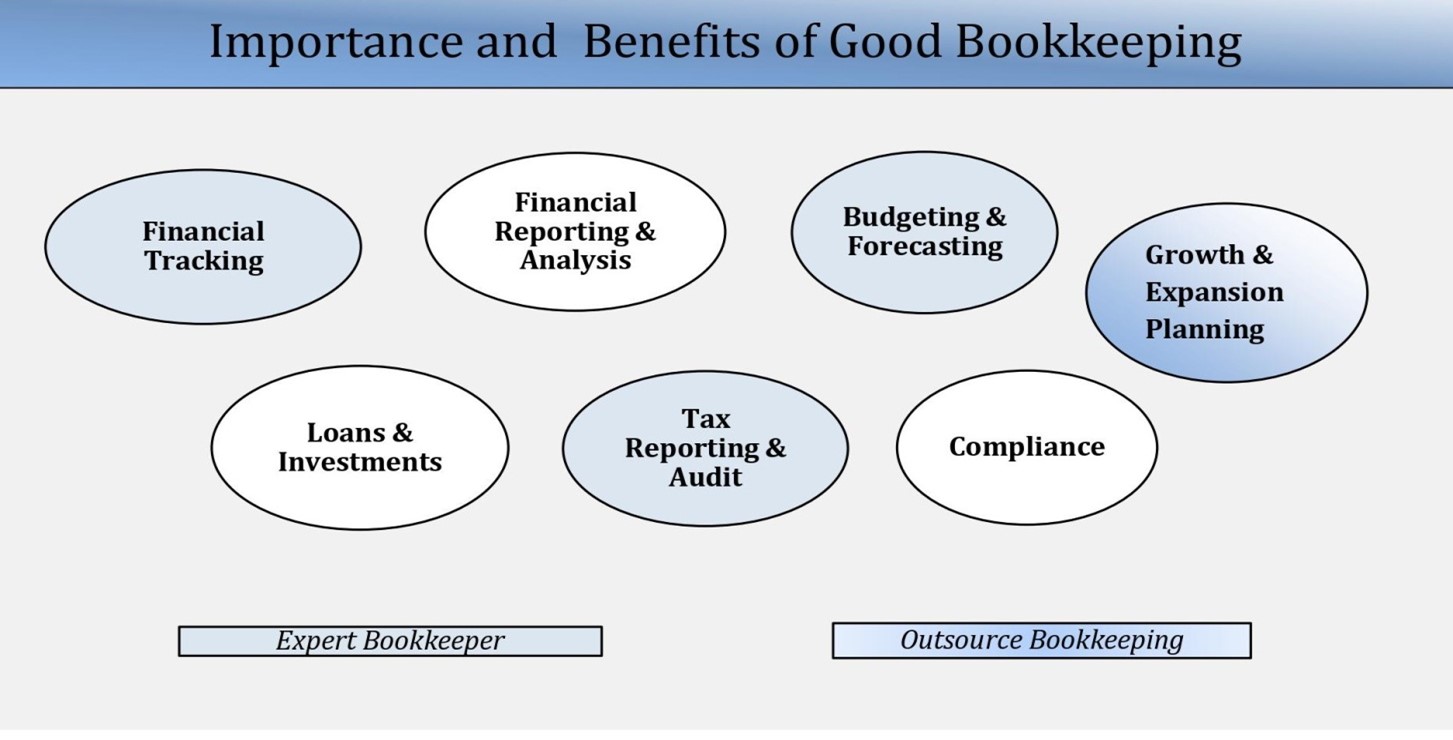

They make sure that all documents follows tax obligation guidelines and laws. They keep track of capital and on a regular basis produce monetary reports that assist vital decision-makers in a company to push the service ahead. Additionally, some bookkeepers additionally help in enhancing payroll and invoice generation for a company. A successful accountant needs the adhering to abilities: Precision is vital in financial recordkeeping.

They typically start our website with a macro perspective, such as an equilibrium sheet or an earnings and loss declaration, and then drill right into the information. Bookkeepers make sure that supplier and customer records are constantly as much as date, also as individuals and businesses change. They may likewise require to coordinate with various other departments to make sure that everyone is utilizing the same data.

The Of Stonewell Bookkeeping

Entering bills right into the accountancy system allows for precise planning and decision-making. This helps services get repayments faster and enhance cash money flow.

This helps stay clear of disparities. Bookkeepers regularly carry out physical inventory counts to prevent overemphasizing the value of possessions. This is an important facet that auditors meticulously analyze. Entail internal auditors and contrast their counts with the videotaped worths. Accountants can work as freelancers or internal staff members, and their compensation varies relying on the nature of their employment.

That being claimed,. This variant is influenced by elements like place, experience, and skill level. Consultants typically charge by the hour however might offer flat-rate plans for details jobs. According to the US Bureau of Labor Data, the typical bookkeeper income in the USA is. Bear in mind that wages can vary depending on experience, education, area, and sector.

The Ultimate Guide To Stonewell Bookkeeping

A few of the most common paperwork that organizations need to send to the federal government includesTransaction details Financial statementsTax conformity reportsCash flow reportsIf your accounting depends on day all year, you can stay clear of a lots of tension during tax period. Bookkeeping. Perseverance and attention to information are key to far better accounting

Seasonality is a part of any task on the planet. For accountants, seasonality indicates periods when payments come flying in via the roof covering, where having outstanding work can come to be a major blocker. It ends up being critical to expect these minutes beforehand and to finish any kind of stockpile before the stress duration hits.

The 30-Second Trick For Stonewell Bookkeeping

Preventing this will reduce the threat of setting off an internal revenue service audit as it offers an exact depiction of your financial resources. Some typical to maintain your personal and business financial resources different areUsing an organization credit rating card for all your service expensesHaving different monitoring accountsKeeping invoices for personal and overhead different Picture a globe where your accounting is done for you.

These assimilations are self-serve and need no coding. It can immediately import data such as staff members, projects, classifications, GL codes, departments, work codes, expense codes, taxes, and a lot more, while exporting expenses as bills, journal access, or credit card fees in real-time.

Think about the following tips: A bookkeeper who has functioned with businesses in your industry will much better understand your certain demands. Ask for references or check on the internet testimonials to ensure you're working with somebody trusted.